The federal estate tax is a burden on family businesses. Not only does the tax threaten to close family businesses, it also takes capital away from the business to pay for expensive estate planning.

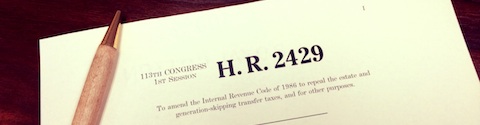

Federal Estate Tax

Tax Reform

Our complex taxcode makes it harder for family businesses to survive, a simpler and fairer tax code is needed for all.

State Death Taxes

18 States currently impose an estate or inheritance tax, Indiana, North Carolina, Ohio and Tennessee recently repealed their inheritance and estate taxes.

Regulations

The ever growing list of regulations are adding hours of compliance on family businesses. Limiting the growth of future regulations and reducing the current number of regulations can help reduce the stress on family businesses.

From The Blog

Supporting Family Businesses Through Pro-Growth Tax Reform

The Family Business Coalition (FBC) has issued a letter to Speaker Mike Johnson and other House Republican leaders…

Over 150 organizations join FBC letter supporting House bill

Last week, Representatives Randy Feenstra (R-IA) and Sanford Bishop (D-GA) introduced the Death Tax Repeal Act companion bill in the House with…

Sen. Sanders introduces “For the 99.5 Act” targeting family businesses

Last week, Senator Sanders (D-VT) introduced the For the 99.5% Act. The legislation calls for raising the top death…